See the Comox Valley through the lens of our live webcam.

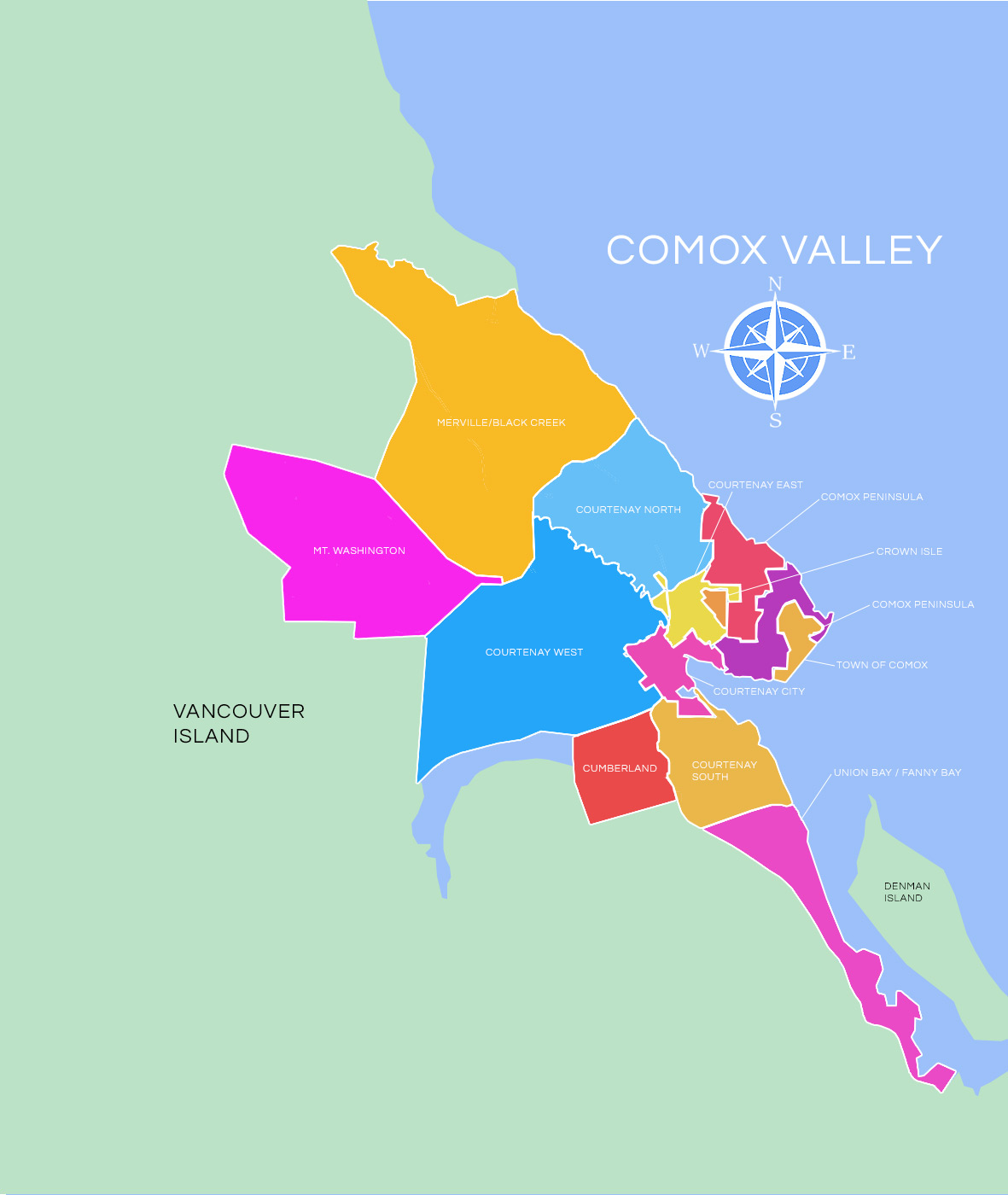

Comox Valley Regional Map

The Comox Valley, nestled between the mountains and the sea, offers a picturesque setting and a vibrant community atmosphere. From its breathtaking natural landscapes to its rich cultural heritage, the Comox Valley attracts residents and visitors alike. With a diverse range of amenities and recreational opportunities, the Comox Valley provides a high quality of life for its residents. The real estate market in the Comox Valley reflects its desirability and lifestyle offerings. With a mix of housing options ranging from waterfront properties and suburban homes to rural estates and acreages, the valley accommodates a variety of preferences and budgets. Please use this map below to gauge the location of each neighbourhood in the Comox Valley.